Newsroom

Challenges and Opportunities in Europe’s Chemical Sector Amid Economic Shifts

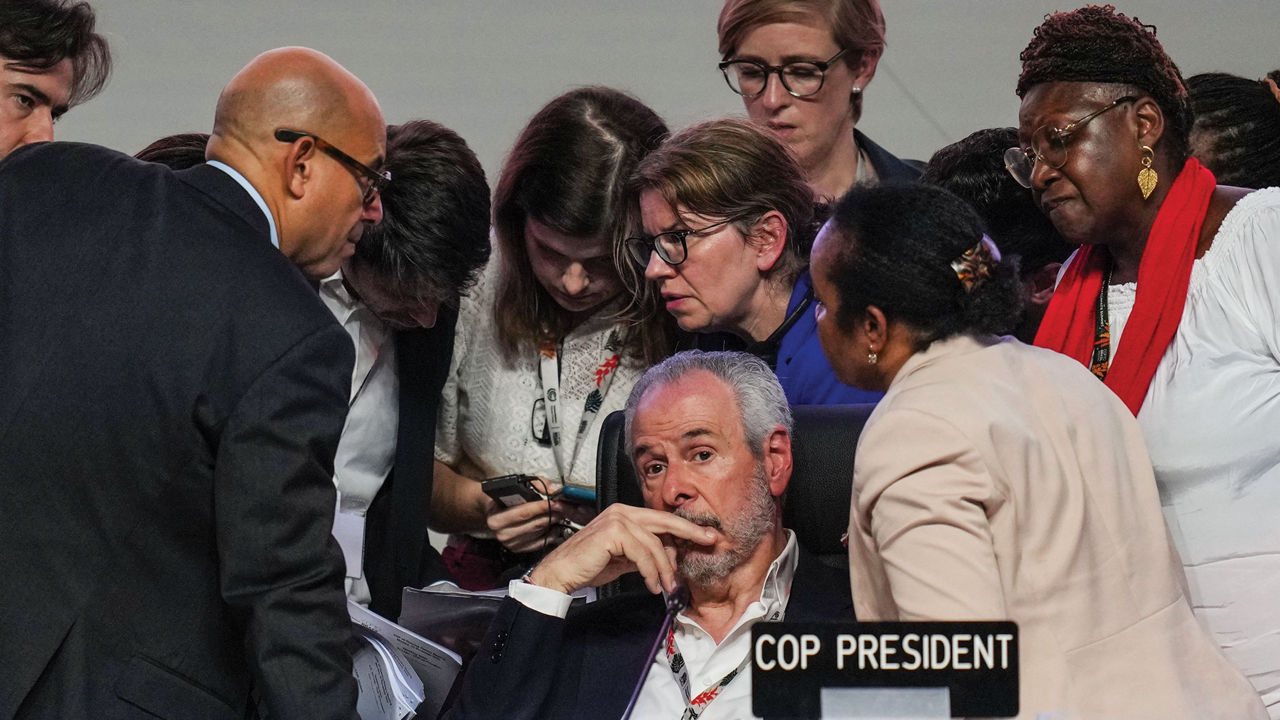

The term ‘deindustrialization’ has gained traction in discussions regarding Europe, especially in light of increasing overseas competition, notably from China, and rising operational costs, particularly in energy. This challenging landscape has led to the closure of numerous manufacturing facilities across Europe. Recently, Wacker announced significant layoffs, while Resonac revealed plans to reduce its workforce in Germany due to these ongoing pressures. The prevailing concern is that Europe may not experience a typical recovery from this downturn, potentially signaling a long-term trend of deindustrialization.

European Industry Faces a Tough Landscape

According to the European Chemical Industry Council (Cefic), the outlook for the European chemical sector remains bleak, with projections indicating a decline in output by over 2% in 2025. In response to current economic pressures, Wacker Chemie has announced a strategic plan to cut costs by approximately $350 million by 2027, which includes eliminating over 1,500 jobs primarily in Germany. CEO Christian Hartel highlighted that soaring energy prices and bureaucratic hurdles are significant impediments to the industry’s growth in Germany.

In a similar vein, Japanese chemical manufacturer Resonac has decided to eliminate 700 positions and close plants producing graphite electrodes due to sluggish market demand and aggressive pricing from competitors. Earlier this year, the company announced the closure of graphite facilities in China and Malaysia due to oversupply issues stemming from Chinese manufacturers. Despite these cuts, Resonac will maintain operations at its graphite plants located in Austria, Japan, Spain, and the United States.

Global Chemical Industry Dynamics

Nevertheless, market dynamics can shift unexpectedly. In the early 2000s, the US chemical industry faced similar challenges driven by high natural gas prices, prompting companies to consider importing liquefied natural gas. However, by the decade’s end, advancements in shale gas extraction revitalized the industry, leading to an unprecedented boom in US chemical production. This history suggests that Europe may also be on the verge of an unforeseen turnaround.

Innovations and Investments Driving Growth

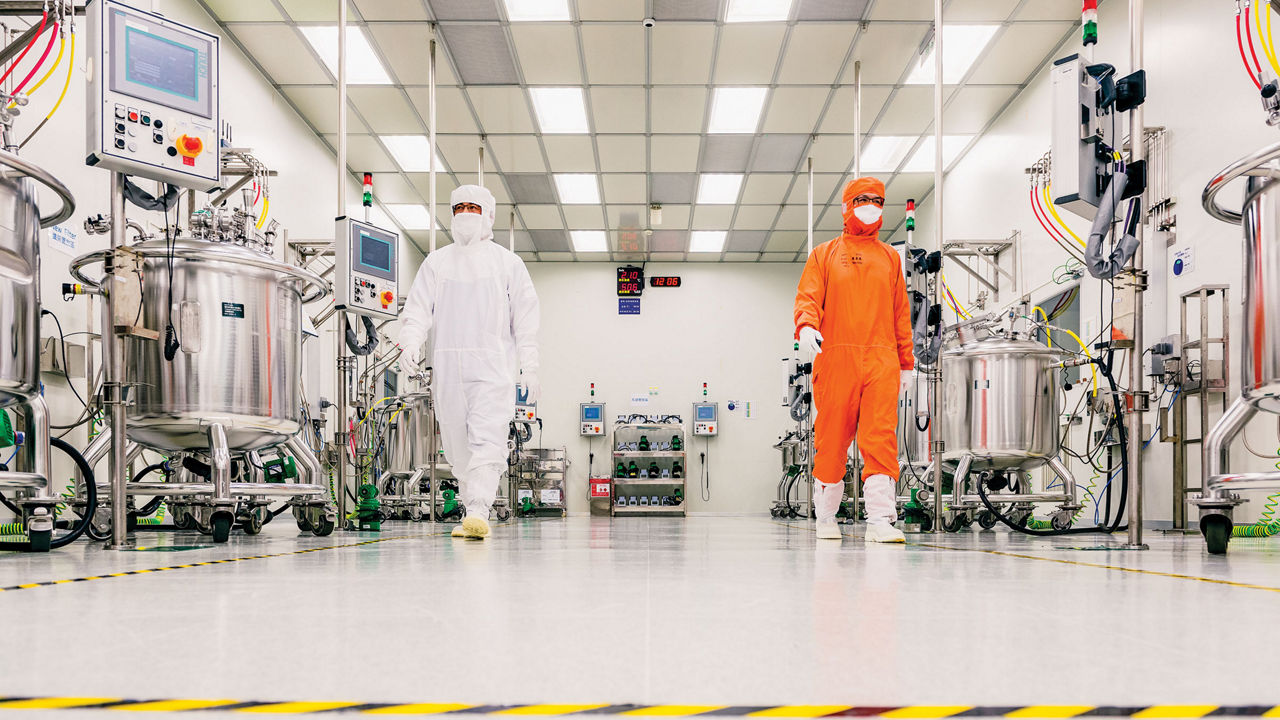

Merck KGaA recently inaugurated a new facility at its semiconductor materials complex in Kaohsiung, Taiwan, following a significant investment of €500 million (around $580 million). This state-of-the-art facility will focus on materials for thin films used during semiconductor chip fabrication. Demand for chips in artificial intelligence applications has driven record sales for Merck’s thin film segment in recent quarters. The new site will also produce specialized formulation materials and gases essential for chip manufacturing.

Dangote Petroleum Refinery and Petrochemicals has chosen UOP technologies to enhance its refining and polypropylene operations in Lekki, Nigeria. The expansion aims to increase refinery capacity by 650,000 barrels per day by 2028, bringing the total to 1.4 million barrels per day. Additionally, Dangote plans to utilize Honeywell’s Oleflex technology for propane dehydrogenation, targeting an annual production of 750,000 metric tons of propylene to bolster polypropylene production to 2.4 million metric tons.

Emerging Technologies and Strategic Partnerships

Elementis has acquired Alchemy Ingredients for $22 million, aiming to diversify its portfolio in personal care ingredients. Alchemy specializes in biobased thickeners, surfactants, and gel bases primarily derived from sugar-based chemistry. Elementis CEO Luc van Ravenstein noted the growing trend towards natural formulations in the skincare market as a driving factor behind this acquisition.

Milliken & Company has partnered with Numat Technologies to incorporate metal-organic frameworks (MOFs) into textiles designed for self-decontaminating personal protective equipment (PPE). Numat’s MOFs are engineered to capture various hazards faced by professionals in chemical and biological fields, with the ability to degrade many toxic substances catalytically. The technology has received endorsements from the US Department of Defense.

Defense and Biopharma Advances

Polish chemical companies Grupa Azoty and Nitro-Chem are collaborating to produce high explosives such as octogen (HMX) for both domestic use and export. The partnership may extend to RDX production as well. Grupa Azoty is tasked with designing equipment for installation at Nitro-Chem facilities in Poland, marking a pivotal step towards enhancing Poland’s defense capabilities.

Protego Biopharma successfully secured $130 million in a Series B funding round aimed at advancing its lead drug candidate, PROT-001, through further clinical trials. The company focuses on treating conditions arising from protein misfolding. PROT-001 targets AL amyloidosis, a rare disease linked to misfolded immunoglobulin proteins that can harm vital organs. Protego’s innovative approach involves molecules that act as ‘chaperones’ to facilitate correct protein folding.

Regeneron Pharmaceuticals has entered into an agreement with start-up Tessera Therapeutics worth $150 million upfront and up to $125 million in milestone payments for co-developing a gene-editing therapy aimed at α-1 antitrypsin deficiency (AATD). This promising treatment is designed as a one-time intervention to permanently address the genetic mutation causing AATD. Tessera is preparing to seek FDA approval for initiating clinical trials soon.

“The prevailing concern is that Europe may not experience a typical recovery from this downturn, potentially signaling a long-term trend of deindustrialization.”